WTF Just Happened To The Mortgage Rates?!

Should You Trust the Hype About Dropping Mortgage Rates?

A Deep Dive into Arizona’s Housing Market and What It Means for You

This is a condensed version for convenience. For the full video you can find that HERE

When it comes to real estate, few topics get as much attention as mortgage rates. Scroll through social media and you’ll see endless posts from agents and lenders celebrating every small dip: “Rates just dropped!” or “Mortgage rates hit 10-month lows!”

But here’s the truth: not all drops are created equal. A slight dip from 6.8% to 6.7% might sound exciting, but in reality, it changes your monthly mortgage payment by about $30. Compare that to a full percentage point drop, which can save hundreds of dollars every month, that’s when it really matters.

So, let’s break down the noise and get into what’s actually important if you’re thinking of buying, selling, or renting in Arizona in 2025.

The Problem With “Rates Are Dropping!” Posts

Real estate professionals love to share flashy headlines about falling rates. But many of these posts exaggerate tiny changes, making them look bigger than they are. For example, a shift of just 0.05% in rates is spun into “the lowest levels in 10 months!”

Why does this happen? Because graphs and numbers can be framed to tell almost any story. But as a buyer or seller, you don’t need hype, you need clarity.

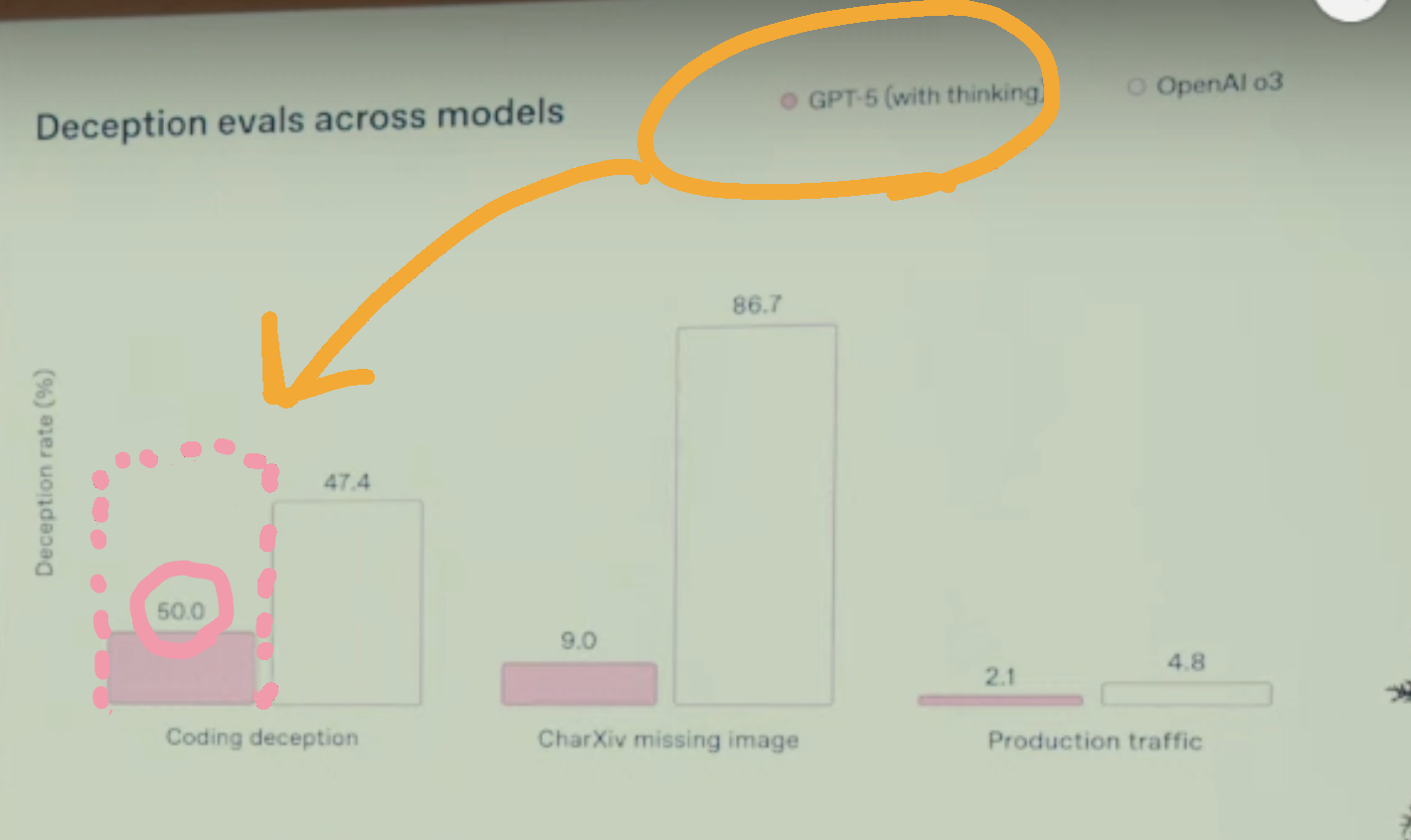

One of my favorite graphs of all time are these two from ChatGPT and OpenAI. The "GPT Models" graph is a meme, while the one in pink is a genuine screenshot from their keynote presentation. Any graphs, when the X or Y axis are adjusted to small enough numbers, can seem massive. The scale can be important when we consider what the resutls truly mean.

If we had a headline of "The lowest mortgage rates in the last 10 years" that is a meaningful headline, and one we should have all followed during the COVID times. When you shrink the timeline to 10 months, it's still considered good news, but the scale matters.

The reality is this: unless rates drop by at least a full percentage point, the effect on your monthly payment is often negligible. A few dollars here or there won’t determine whether you can afford a home. Keep in mind I say this with love. You may argue that the $50/mo savings is massive, which it is, but I know that 99.9% of you have anywhere from $25-$100/mo in non-neccessary subscription services. If the $100/mo was keeping you from purchasing a home we could find that easily in most household statements, so let's start there.

What About the Federal Reserve?

Many people assume that when the Federal Reserve cuts rates, mortgage rates immediately follow. That’s not entirely true.

Yes, mortgage rates often trend alongside the Fed’s decisions, but they’re not tied directly. In fact, mortgage rates often anticipate Fed moves months in advance. This means that by the time the Fed makes an announcement, the market may have already “baked in” the change.

So, don’t expect instant savings on your mortgage payment the day after a Fed announcement. The impact tends to show up gradually, over months, not days.

How Mortgage Rates Affect Your Payment

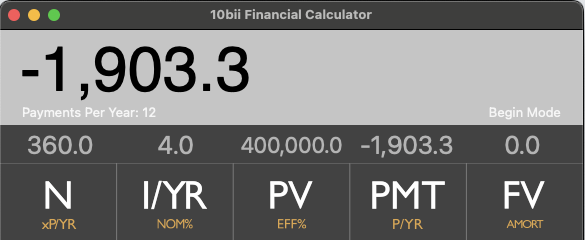

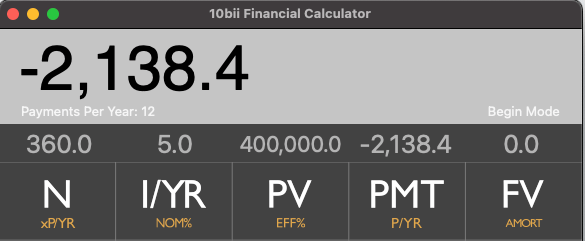

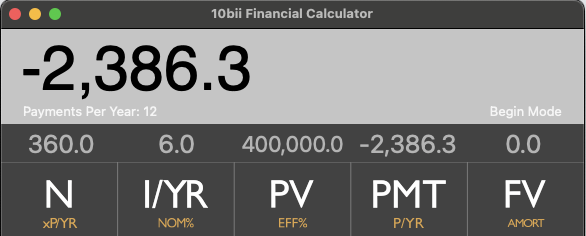

Let’s put numbers into perspective.

-

A $400,000 loan at 6.8% = ~$2,566/month.

-

A $400,000 loan at 6.7% = ~$2,536/month.

That’s a difference of just $30.

Now compare:

-

A $400,000 loan at 6% = ~$2,398/month.

- A $400,000 loan at 5% = ~$2,147/month.

Each 1% change is around a $240/mo swing. The difference between a 6% and a 4% is just under the cost of the average car payment in America. Which sounds like it could be low, saying "just under the average", but in reality that speaks more on the car industry than housing...on what world is the average car payment $700....crazy haha.

So when you hear that rates are “dropping,” make sure to ask: “By how much?”

At that point you can run the math yourself and make a decision on if it is enough to move the needle for you. Home purchasing should be personal and never based on what others want for you or expect you to do.

Will Rates Go Back to 3%?

This is the million-dollar question.

Many buyers are holding off, waiting for rates to return to the historically low levels of 2020 and 2021. But history suggests those days are behind us unless we hit another major recession.

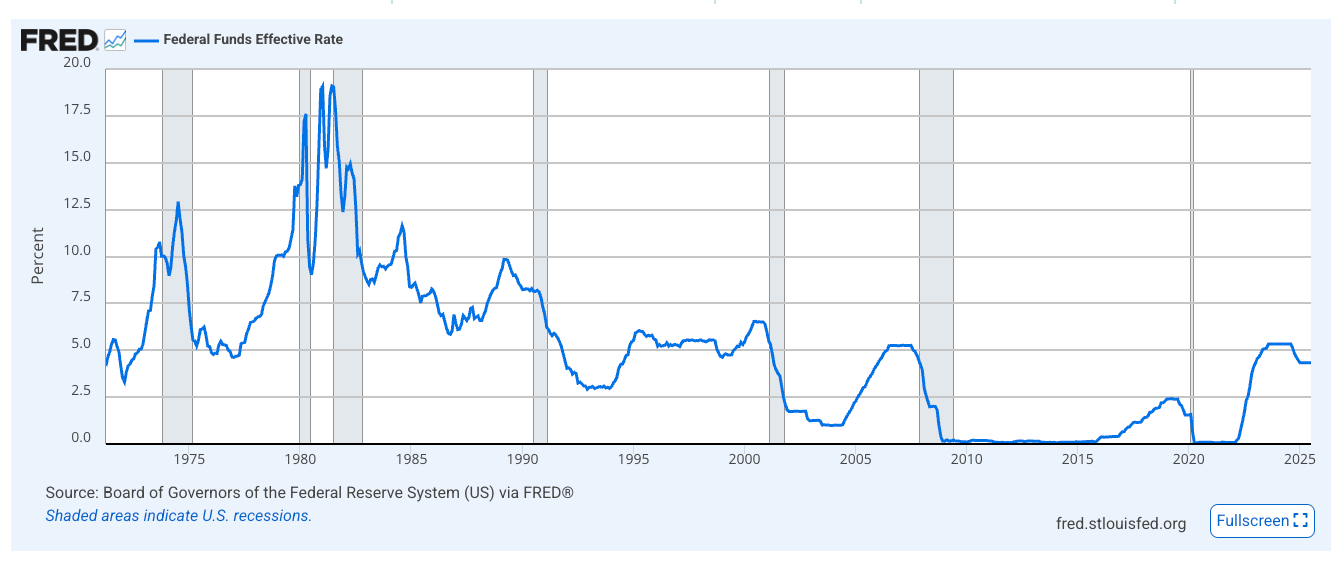

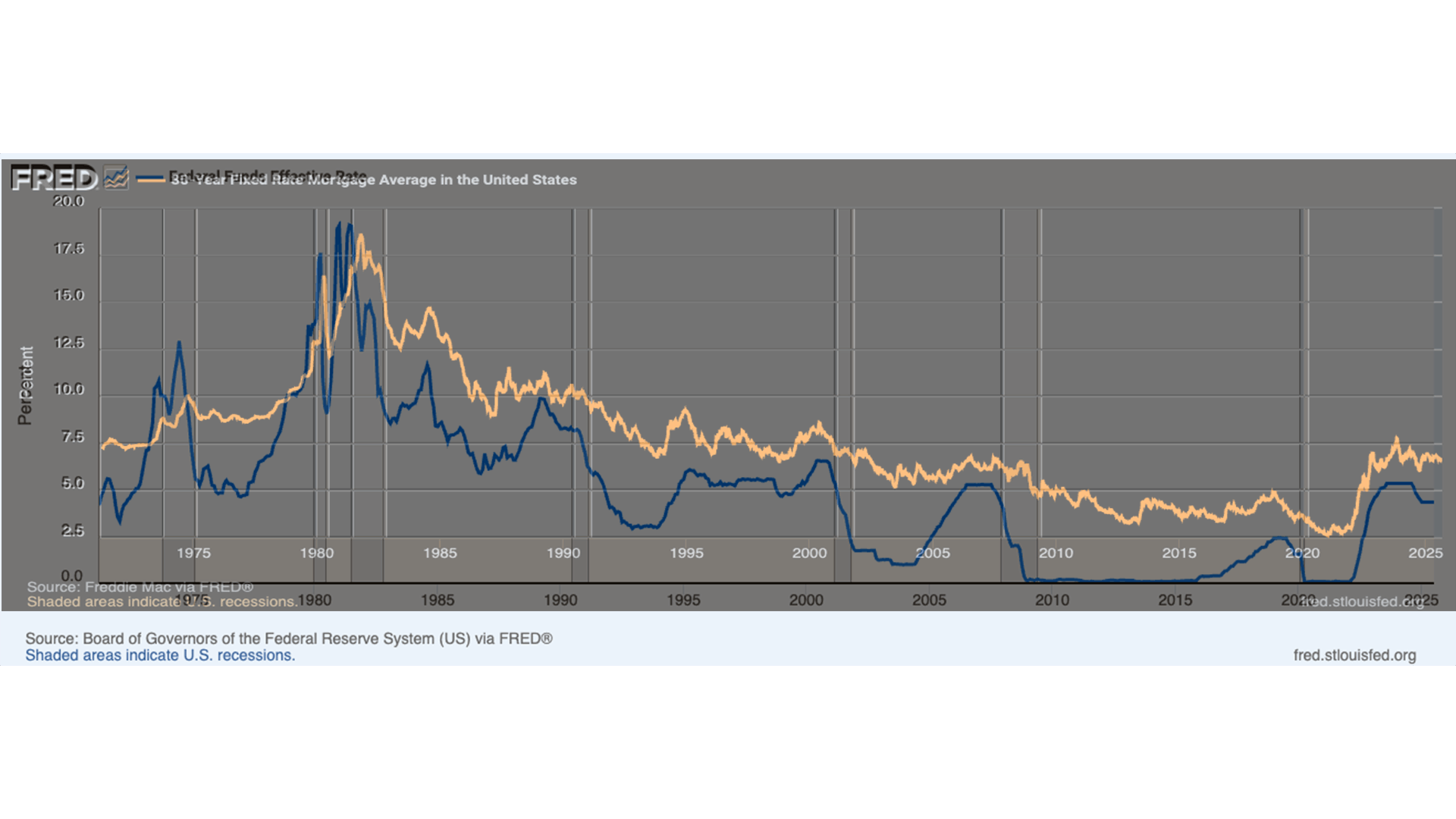

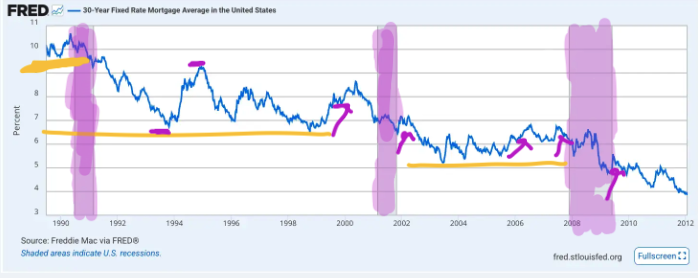

Looking back at the last few decades, every meaningful drop in rates was tied to a recession. In the graph attached below, each purple highlighted area was indicated as a recession, according to the FRED.

The 1990s with the Gulf War, the dot-com bubble, 2008 which we are all familiar with, and most recently the COVID-19 crisis, all brought rates down to new baselines.

From averages in the 9's, it dropped to around 6.5% in the late 90's, then 5% around 2000s, following mid 3's in 2010's, and lastly coming into the high 2's right after COVID. New baselins after each reccesion for the last 30 years of history. In hindsight of editing this blog based on the video I should have gone back 100 years. Still, the last 30 certianly paints an interesting picture when it comes to our future.

Without a similar economic shock, rates are unlikely to return to the 2–3% range anytime soon.

I am editing this blog on 09/08/2025. My guess is rates bounce froun 5's and 6's until the next recession. And I believe that recession could come at any time in the next 5 years.

Buying vs. Renting: The 8-Year Rule

Now let’s tackle the big question: should you buy or rent in 2025?

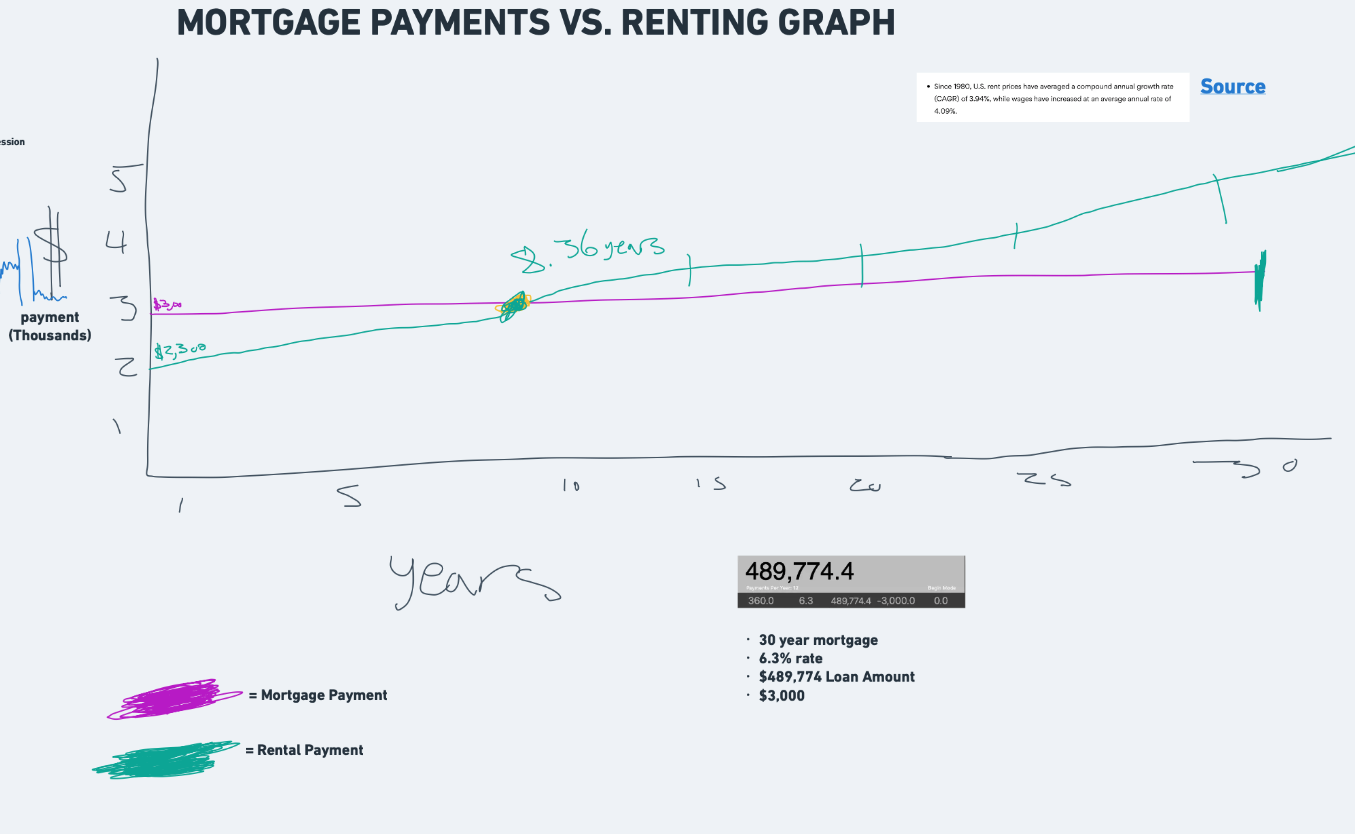

The average Arizona home is around $515,000. With a 5% down payment and today’s rates (~6.3%), your mortgage payment would be about $3,000/month. Renting a similar home might cost closer to $2,300/month.

Bare with me on the image below, it is a screenshot from the video prep I have. If you watch the full video over on youtube.com/@colerepp it will make more sense.

At first glance, renting looks cheaper. But here’s the catch: rent increases every year. Historically, rent rises about 4% annually. That means within 8 years, your rent would equal (or exceed) the cost of owning.

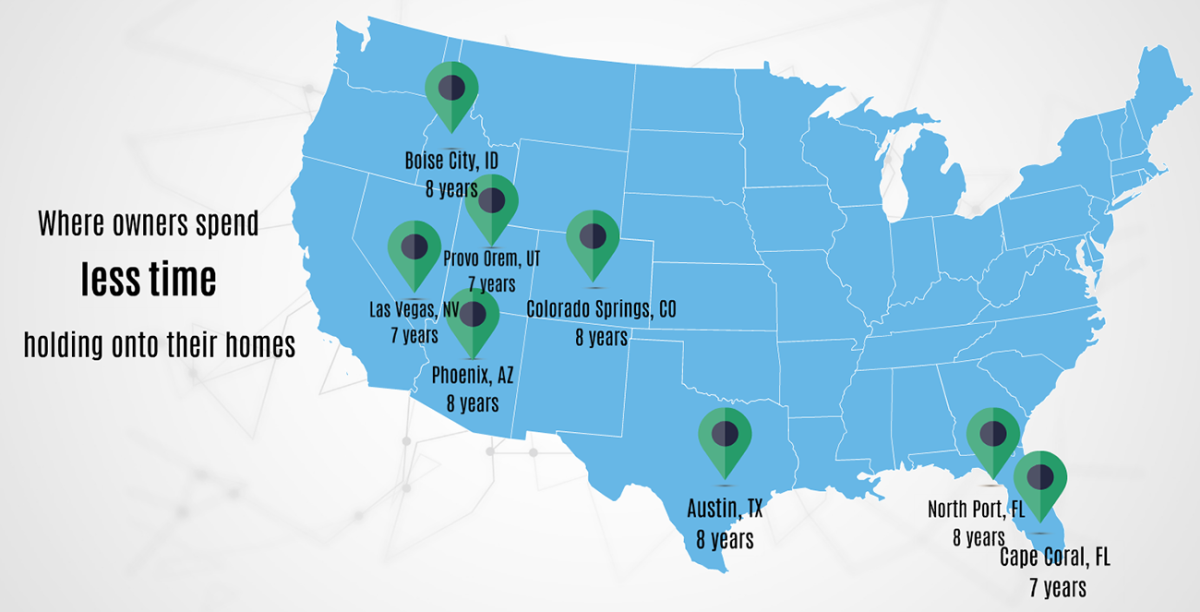

But here’s where many Arizonans miss out: the average homeowner in the state sells after just 8 years. That’s right at the break-even point. If you can commit longer than that, you’ll come out ahead.

So if you would like to be in the top 1%, 5%, 10% or even just apart of the 23% not swimming in debt, you need to make decissions that the 99% don't. Or 95%. Or 90%...and so on.

Owning a home for 8 years without selling can feel impossible. We all get excited. We want something new. We crave change.

Or we tell ourselves that we will rent the house out after a year or two only to find out the rent doesn't even come close to covering the mortgage....which was the entire point of this comparison to begin with.

Stay focused. Lock in on 8 years and your golden.

The Arizona Market Today

As of late 2025, Arizona markets are heating back up for sellers. Inventory is low, demand is rising, and cities like Scottsdale, Chandler, and Fountain Hills are seeing strong upward trends.

-

15 cities improved for sellers this month.

-

Only 2 shifted in favor of buyers.

-

6 cities are officially seller’s markets, with 4 balanced and 7 leaning toward buyers.

What does this mean? If you’re a seller, conditions are better now than they were just a few months ago. If you’re a buyer, you’ll need to be patient, strategic, and realistic about timing.

Final Thoughts: What Should You Do?

The truth is, nobody can perfectly predict mortgage rates or the timing of the next recession. But you can make smart, math-based decisions today:

-

Ignore the noise. Make a buying decision that makes sense for you.

-

Plan for the long term - buying only makes sense if you’ll hold the home for 8+ years.

-

Don’t wait for 3% rates - those were a once-in-a-generation event.

-

Focus on affordability today - if the payment works for you now, that’s what matters most.

For a full video guide, make sure to check out my YouTube Video Here

And if you are looking to buy or sell in Arizona, we would love to earn your business!

Cole@whitelabelaz.com or text us directly at 602-350-5624

✅ Thinking about buying or selling in Arizona? Let’s talk. I’ll help you cut through the noise, understand the numbers, and make the decision that’s best for your future.

GET MORE INFORMATION